Working with owners and buyers of manufactured (mobile) homes, as we do here, means spending time countering myths and misconceptions left over from the bad old “trailer park” days.

It doesn’t help when those misconceptions are spread by popular media.

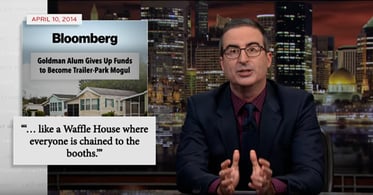

It happened recently, during an otherwise-excellent Last Week Tonight segment that showed how large corporations that own mobile home parks profit on the backs of low-income homeowners. Host John Oliver compared the homeowners to lobsters in a restaurant tank waiting to be eaten, and he’s right. (Note: viewer discretion is advised if you’re sensitive to cursing).

It happened recently, during an otherwise-excellent Last Week Tonight segment that showed how large corporations that own mobile home parks profit on the backs of low-income homeowners. Host John Oliver compared the homeowners to lobsters in a restaurant tank waiting to be eaten, and he’s right. (Note: viewer discretion is advised if you’re sensitive to cursing).

The misconception comes near the middle of the segment, where finance guru Dave Ramsey opined that because mobile homes lose value, they’re terrible investments.

Ramsey’s right—if you think a manufactured home is a car. There is even a Blue Book for manufactured homes that, just like the one for cars, decreases their value every year. This started when mobile homes were financed like cars. In many states, they still are.

A house isn’t a car

But modern manufactured homes aren’t mobile, and a house isn’t a car. Modern homes are built to a national housing code that adds safety, quality, and energy efficiency. In New Hampshire, manufactured homes are titled, bought, sold, and recorded as real estate. This offers consumer protections for home owners and helps them build value in their homes.

Our Welcome Home Loan program has made more than 1,000 mortgage loans for manufactured homes. We use true appraisals that consider comparable sales on the market, just as would happen in appraising any house. We determine a home’s market value by looking at recent sales and listings in the area, comparing similar homes of the same size, and considering how long it takes those homes to sell.

Location, home size, and condition matter, but the year the home was built is one factor among several, not the determining factor.

And we’re seeing manufactured-home values increase in line with the rest of the real estate market.

Value backed by studies

Two studies confirm our perceptions. A “Manufactured Housing Asset Appreciation Study” published in 2003 by Consumer Union showed that manufactured housing tends to depreciate or lose value when sited on land not owned by the homeowner. This reflects the risk John Oliver described: A manufactured-home park owner who increases rents for no reason can strip all the value from the park’s homes.

As he pointed out, it’s a different story when the homeowners own the park. A study by the Carsey Institute of the University of New Hampshire, “Building Value for Homeowners in Manufactured Housing Parks,” found that residents who own their manufactured-home communities and have access to fair mortgage financing see their homes’ values increase, along with faster home sales at better prices.

That’s why, when Oliver asked at the end of his segment, “Is there anything that can be done here?” he offered as a solution ROC USA and its network of technical assistance providers (of which we are one). Together, we’ve helped more than 15,500 homeowners take charge of their communities and begin to build value in their homes.

I give Oliver a lot of credit for showing his 6.1-million viewers how vulnerable manufactured home owners can be, as well as what an affordable (and asset-building) opportunity manufactured homes can be—when houses aren’t treated like cars and the homeowners control the land.

Jennifer Hopkins is the Single-Family Housing Program Manager at the New Hampshire Community Loan Fund. NMLS #395262. This blog post was originally posted here.