For 20 years, ROC USA and I have been heavily involved in the Innovations in Manufactured Housing or I’M HOME network. This is group of innovators and advocates in the HUD-code Manufactured Housing sector.

I’M HOME is now hosted by the Lincoln Institute of Land Policy, which those close to ROC USA might know is led by George “Mac” McCarthy. Mac was at the Ford Foundation when he initiated funding for what I’ll call consumer protections in this oft-overlooked housing sector.

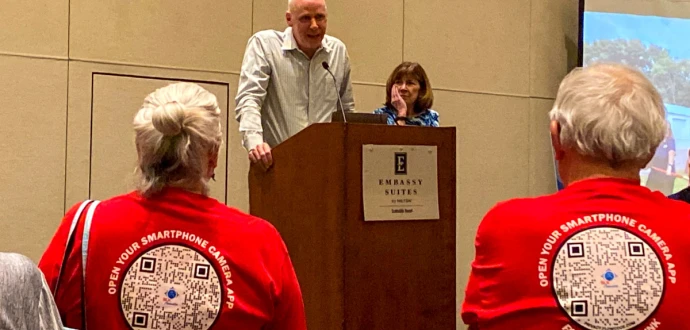

This year’s event was like no other. First, there’s the job of introducing Emily Thaden, ROC USA’s new President!

Second, the number of homeowners from privately owned MHCs – in New Mexico, Arizona and California – was unprecedented and a complement to the 20 ROC leaders that we had join us in Phoenix. The ROC Association held its annual meeting live and online and did some organizing. Plus, they attended, spoke at, and generally motivated everyone at the I’M HOME event with their accomplishments!

It is so much fun to hear and see them motivating change.

Third, I had the privilege of following Andrea Levere, ROC USA’s Board Chair, in her remarks at our Board’s reception. (Yes, we held an in-person Board meeting in Phoenix, too!)

She, Emily and I spoke on the transition in leadership. I thought I’d share my remarks here, noting up front that I followed Andrea’s kind comments about me.

I said everything ROC USA has accomplished is the result of ROC leaders and Members, TA affiliate and ROC USA staffs, the Board and myriad donors, lenders and partners. And it’s a lot: 331 ROCs, almost 23,000 homes in 21 states.

And it’s not enough!

There are 43,000 Manufactured (Mobile) Home Communities in the U.S. For 40 years – starting in NH and now operating nationally – we have helped each co-op acquire their one community. It’s been 1 by 1 to 331 ROCs.

But, in 2014, two mega-trends (in our niche housing market) took hold:

- Consolidation of ownership has ramped up dramatically. I say 2014 was the turning point because that’s the year Freddie Mac began competing with Fannie Mae for financing investors who buy communities. They have financed billions by now and their low-cost loans allowed investors to buy, raise rents and fees, refinance and pull-out equity to go buy more. Many portfolios were built this way.

So now, when communities are being sold, they’re more likely to be sold in portfolios of multiple communities. This challenges our 1-by-1 historic work. That still only works in states that have Right of First Refusal or Opportunity to Purchase laws, as nine now do.

- The low interest rates and entry of many more small, medium and large Private Equity investors created more demand for MHCs than there is supply and prices have been bid up. And because the entire housing market grew so expensive, the options that homeowners in MHCs have for moving are limited. These investors figured that homeowners would pay more just to stay in place. That’s why you see headlines about site rents and fees in MHCs going higher and higher.

As Frank Rolfe put it, “Owning a mobile home park is like owning a Waffle House where everyone is chained to the booths.”

These two core issues led me to tell the Board last August that they should invest in a new start-up subsidiary, which I would lead, and to hire my successor, someone with a different skill set, to lead ROC USA.. They agreed and the organization has in the last 12 months:

- Invested $2 million in the start-up of Integrity Community Solutions, a subsidiary to ROC USA that shares the same mission but will take a different pathway to delivering it. ICS will build an impact equity fund and acquire portfolios for interim ownership. After completing infill and otherwise preparing the community for resident ownership, ICS will provide homeowners with a Right of First Refusal (ROFR). ROC USA’s core services of Technical Assistance and community financing will be available to them at that time.

Our goal is break up portfolios for resident ownership in states that do not have ROFR laws.

- Launched an executive search to locate an experienced leader in innovative affordable housing finance and public/private partnerships to better work with philanthropy, the public sector and traditional debt providers to make co-op purchases more affordable for homeowners.

Emily Thaden was hired in March and joined ROC USA in late June. I’m so excited for her and for the future of ROC USA under her leadership. She has both local and national experience and has dedicated her career to shared equity housing. She’s a great fit!

Last week was a full week, and so motivating. It’s usually hard for diverse audiences to understand strategy but I really saw in people’s faces when I explained it. People at I’M HOME understand the challenge that homeowners are up against. On their behalf, we’re being bold. Their head nods let me know that they’re with us – we are after all Better Together!

ROC on!